This story first appeared in The Readout publication. Join The Readout and obtain STAT’s award-winning biotech information delivered straight to your inbox.

Good morning. It’s one other busy information day, and I’m layering up at house to keep away from turning the heater on. Fall is formally right here.

Pfizer pulls sickle cell drug off international markets

In a shock announcement late yesterday, Pfizer mentioned it could pull its sickle cell remedy Oxbryta off international markets as a result of excessive dangers of extreme security occasions, together with deaths.

The transfer is a surprising blow for the drug, which Pfizer received by means of its $5.4 billion acquisition of International Blood Therapeutics in 2022.

The European Medicines Company had been set to carry a listening to in the present day on the remedy, in mild of what it mentioned have been medical trial knowledge exhibiting extra deaths amongst sufferers taking the drug in comparison with a placebo.

Learn extra from STAT’s Adam Feuerstein and Jason Mast.

Bob Nelsen’s agency raises an enormous new fund

ARCH Enterprise Companions introduced in the present day that it raised $3 billion for a brand new fund, one of many largest within the biotech trade.

The downturn within the biotech market over the past couple of years has led many trade traders to alter ways. They’ve forgone investments in early-stage startups with extremely experimental scientific platforms in favor of firms with medication that might quickly head into the clinic and, ideally, be prepared in a couple of years for pharma to amass.

Chicago-based ARCH, nonetheless, is sticking to its long-running technique, making investments primarily based on the staff’s curiosity and frustrations. “We don’t actually care what the market thinks. It’s irrelevant. And we don’t actually care what pharma thinks,” ARCH co-founder and Managing Director Bob Nelsen mentioned.

Learn extra from STAT’s Allison DeAngelis.

Last Medicare resolution on Alzheimer’s medication might take ‘years’

From my colleague Rachel Cohrs Zhang: Medicare’s controversial resolution to situation protection for even absolutely authorised Alzheimer’s medication is right here to remain, per a high CMS official. (This is applicable to new medication like Eisai and Bigoen’s Leqembi and Eli Lilly’s Kisunla.)

Tamara Syrek Jensen, the director of the Protection & Evaluation Group at CMS that’s chargeable for writing nationwide protection dedication insurance policies, doesn’t converse publicly typically, however she did a short fireplace chat at an occasion hosted by the USC Leonard D. Schaeffer Middle for Well being Coverage & Economics yesterday.

Presently, CMS will cowl Alzheimer’s medication if a affected person’s knowledge is collected in a registry to trace how the remedies carry out in the actual world. Jensen mentioned the present registry takes clinicians lower than 5 minutes to finish. The following step can be accumulating knowledge from the registry and medical claims to begin evaluating the medication’ efficiency. “We hope to try this over the following…it’s not gonna take us months, so over the following few years,” Jensen mentioned.

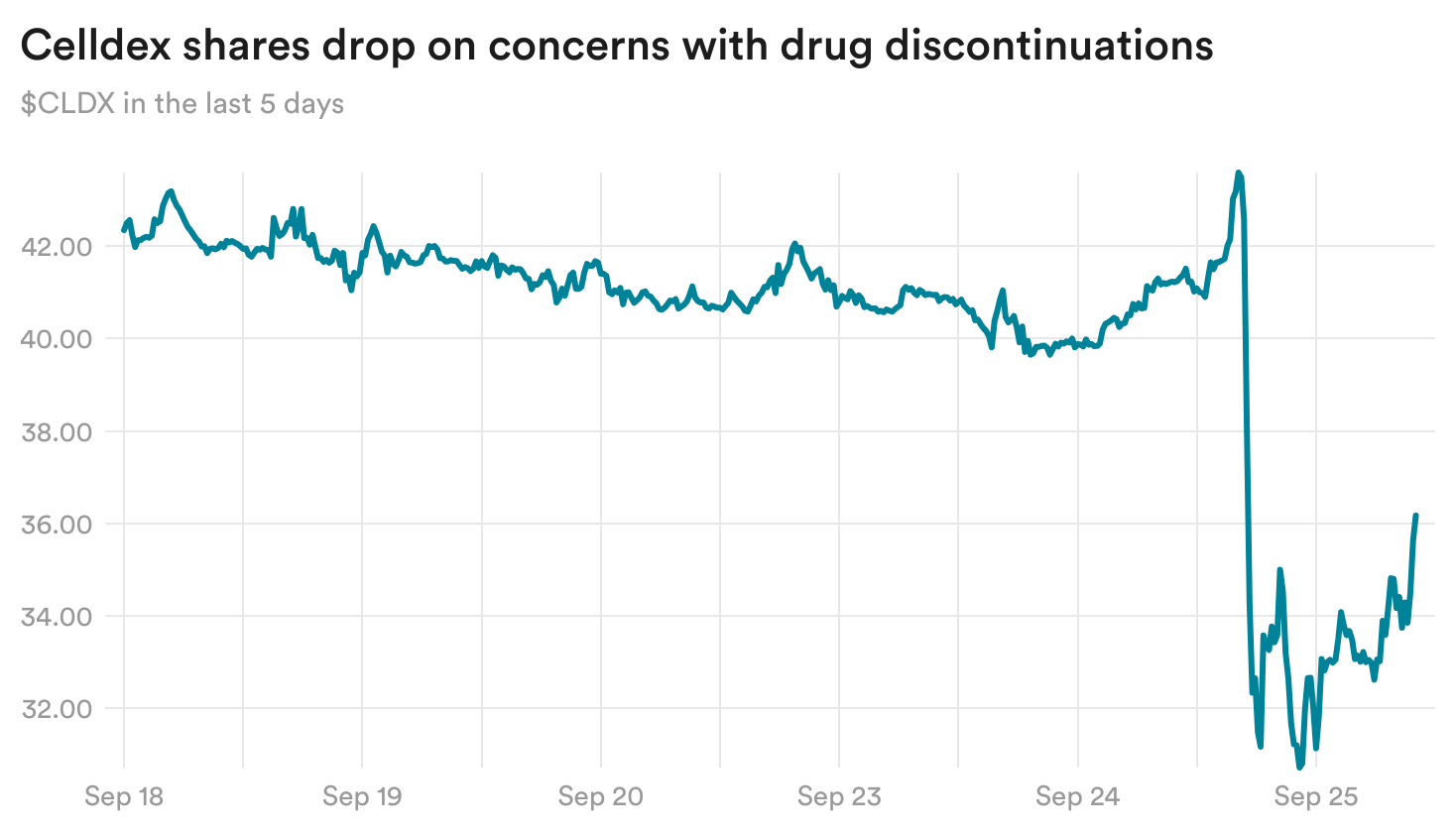

Celldex drug discontinuations elevate questions

Celldex reported yesterday that its experimental medication for a situation that causes power hives diminished hive exercise in sufferers, fully clearing it in some. Nonetheless, there was a excessive fee of affected person discontinuations within the trial, due partly to uncomfortable side effects together with modifications in hair coloration.

These issues despatched the biotech’s shares down 12% yesterday.

Celldex reported no circumstances of anaphylaxis, which observers have been intently looking ahead to. And whereas some handled sufferers noticed a drop of their ranges of neutrophils — a kind of white blood cell concerned within the physique’s immune response — the biotech mentioned that neutrophil ranges didn’t drop with continued dosing and that sufferers who skilled drops didn’t see greater charges of infections.

Learn extra from STAT’s Drew Joseph.

Biotech’s actual property market remains to be the other way up

From my colleague Jonathan Wosen: Biotech firms seeking to hire lab house nonetheless have loads of choices, in keeping with a brand new report from Jones Lang LaSalle, a industrial actual property companies firm.

The provision of vacant house for direct lease or sublease rose from almost 25% final 12 months to 30% by the center of 2024. And rents have dipped almost 9% over the previous 12 months, with per-square foot costs falling from $6.54 to $5.97.

That’s excellent news for firms seeking to increase, and dangerous information for the trade’s landlords. The findings underscore that the stability between provide and demand for lab house stays out of whack, as we beforehand reported.

Throughout the early years of the Covid-19 pandemic, when biotech shares soared and funding {dollars} have been straightforward to come back by, many firms have been in want of house. To satisfy that demand spike, builders started constructing tens of tens of millions of sq. ft — simply as a pointy market downturn pressured biopharma companies to take a extra cautious strategy. JLL expects the scenario to stabilize throughout the subsequent 6 to 12 months, citing each the potential of decrease rates of interest to kickstart the trade’s development and three consecutive quarters of accelerating demand for house.

Extra reads

J&J folds cardiovascular and metabolic drug unit, Endpoints

Generic drug foyer faucets former BIO exec as new CEO, STAT

Ozempic linked to decrease opioid overdose fee in these with diabetes, examine reveals, STAT

Moderna is scolded by a U.Okay. commerce group for providing children $2,000 to take part in a Covid trial, STAT